您现在的位置是:Fxscam News > Platform Inquiries

Bitcoin surges on interest rate cut expectations, cryptocurrency market rebounds

Fxscam News2025-07-22 08:40:59【Platform Inquiries】2人已围观

简介Regular foreign exchange platform,I was cheated by mt4 Forex platform,As the market anticipates the Federal Reserve's imminent announcement of a rate cut to boost th

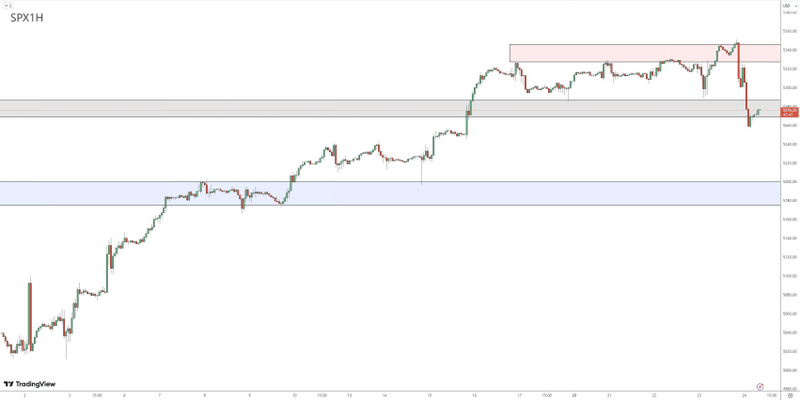

As the market anticipates the Federal Reserve's imminent announcement of a rate cut to boost the economy and Regular foreign exchange platformstimulate demand for speculative assets, the cryptocurrency market is experiencing a noticeable surge. Bitcoin once rose by 6%, reaching its highest point in over a month, while other cryptocurrencies like Ethereum and Solana also followed suit. The market widely believes that there is a high likelihood of a Fed rate cut this time, especially as expectations for a 50 basis point cut bolster market optimism.

Shi Liang Tang, President of Arbelos Markets, stated that the increasing correlation between cryptocurrencies and traditional financial markets is one of the key driving factors behind the rise in assets such as Bitcoin. Additionally, MicroStrategy's recent announcement of increasing its Bitcoin holdings has further boosted investor confidence.

Despite Bitcoin's recent strong performance, market volatility remains significant. Future trends will depend on the Federal Reserve's policy direction and market reactions. As an emerging asset class, cryptocurrencies are playing an increasingly important role in the context of global monetary policy changes.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(48298)

相关文章

- Capital Index Review: Regulated

- Before the ECB decision, the euro faces pressure, while the pound focuses on GDP data.

- South Korea declares a state of emergency, sending the won to a two

- Bank of Japan's rate hike talks attract attention as USD/JPY rises to 158.

- Market Insights: Mar 29th, 2024

- The US dollar steadied as markets assessed Trump's tariff policy and major currencies diverged.

- Korean won rises as parliament passes presidential impeachment motion.

- The rupee hits a historic low as interventions fail to offset slowing growth and uncertainty.

- Unifi Forex Broker Review: High Risk (Illegal Business)

- Federal Reserve officials warn of risks associated with Trump's policies.

热门文章

- Detailed explanation of TMGM Forex trading platform rebate policy: How to maximize your earnings.

- High interest rates drive U.S. junk bond defaults to a four

- U.S. Treasury yields mixed as curve steepens, focus on rates and Trump policies.

- Analysts warned that the Canadian dollar’s rebound is unstable due to tariffs and rate differentials

站长推荐

The ChatGPT craze sweeps through the American workplace, sounding the alarm!

Yen falls, dollar under pressure, market eyes central banks and Ukraine talks.

U.S. dollar strengthens, Euro drops 1% on Trump’s tariff threats and strong U.S. data.

Trump's tariff statement strengthens the dollar, but economists warn of potential backfire.

October 25 update: Clear Street expands trading in Canada, MFSA warns about BBFX.

The Renminbi declined in November but has rebounded, driven mainly by the strong US dollar.

Analysts warned that the Canadian dollar’s rebound is unstable due to tariffs and rate differentials

The US dollar retreated, the pound weakened, and non